Digital Crowdinvestments in Premium Hospitality with FMTG Invest

Via the digital investment platform “FMTG Invest”, the company offers selected guests and interested investors residing in Austria and Germany the opportunity to invest in the company and its premium projects on a selective basis as part of crowdinvestment campaigns. Each investment round is based on one or more projects with a regulatory stipulated use of funds. The special thing about an FMTG crowd investment is that investors can choose between annual interest payments in cash or exclusive Falkensteiner hotel vouchers and thus convert their return into vacation experiences.

Since 2017, over 90 million euros have been generated for the realization of new hotel and premium living projects. At the same time, EUR 9.3 million in interest was paid out on time in 13 interest payment rounds and EUR 16.7 million was repaid to investors on time in five repayment rounds after a term of five years (as at 11/2024).

The FMTG investment offer is aimed at investors with an entrepreneurial spirit who attach great importance to quality and expertise when investing in projects. The underlying investment product is qualified subordinated loans, which require investors to have a corresponding risk-bearing capacity and an awareness of the risks associated with the product. In accordance with the legal requirements, it must therefore be ensured without exception that the necessary legal and risk information is clearly and transparently communicated to investors at all touchpoints in campaign communication and is always easily accessible.

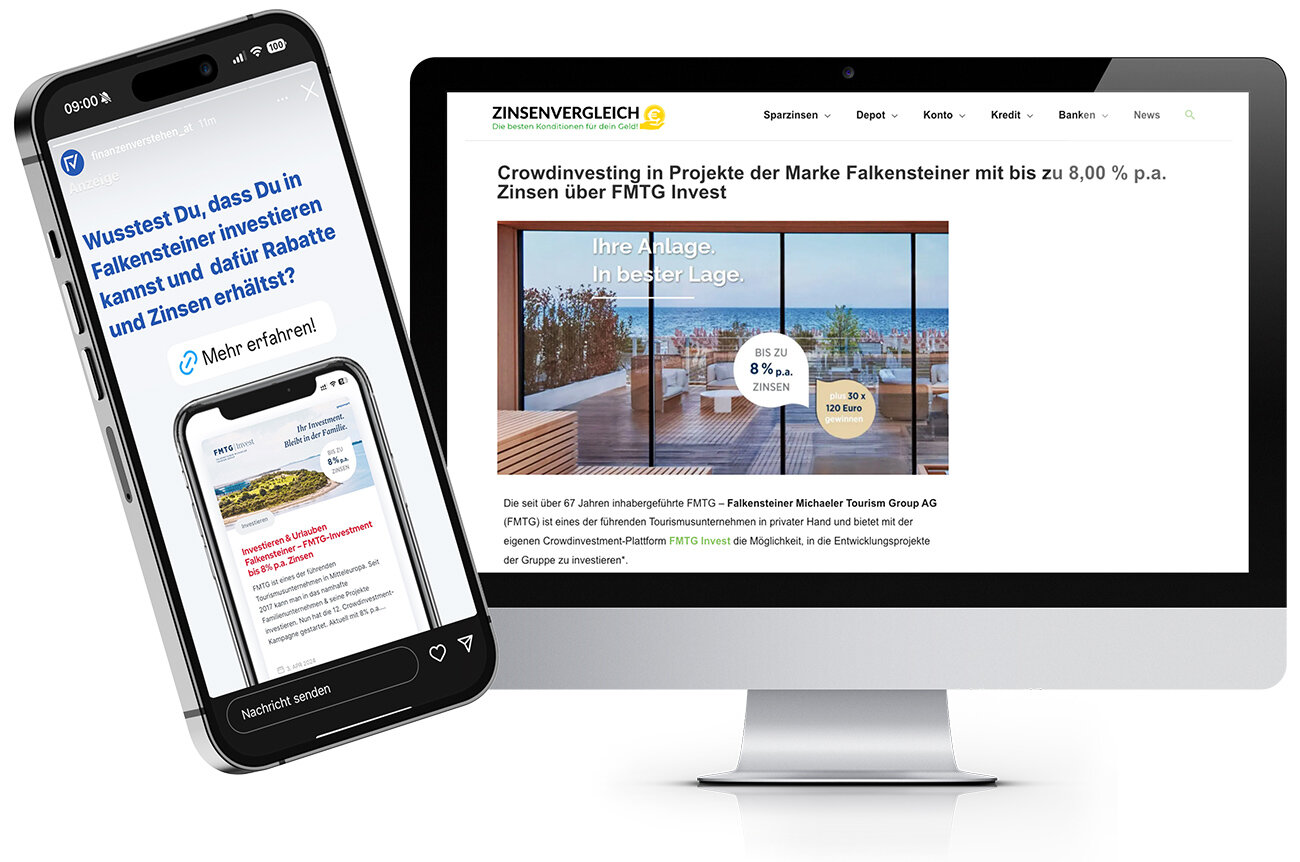

Since 2023, Netzeffekt has made a significant contribution to achieving success twice a year with targeted online communication measures in relevant digital marketing channels. Attention is always paid to the efficient use of the budget. In order to strengthen the recognition value of the renowned “Falkensteiner” brand, a close brand association is promoted in all activities relating to FMTG Invest.

Foto © FMTG

Granular Online Marketing for Efficient Crowdinvestment Communication

High-reach display channels (e.g. target group-specific news platforms, Google Display Network and AdForm) were used programmatically to promote the flow of information to potential investors in the most targeted way possible. Thanks to granular targeting to selected target groups and affinities as well as retargeting to website visitors, very good results were achieved here. In addition, direct bookings were made on expert sites with an affinity for finance, which appeal to this specific target group with an affinity for risk. These included renowned websites of financial publishers who successfully explained and advertised the product primarily via their own newsletters and social media platforms. When using these information channels, the legally compliant presentation of the risk information - directly in the description of the product and the conditions - also has top priority.

Last but not least, SEA was used to generate leads with an appropriate selection of keywords, including for the “alternative investment” product group. The texts displayed were targeted at users with an interest in hotel project development and financial topics. This selection was continuously optimized during the product's subscription period.

GREAT CARE AND CONTINUITY LEAD TO SPECIAL RESULTS

Despite the limited subscription periods defined in advance, the respective funding targets were achieved for each campaign and often even exceeded. With each campaign and the knowledge gained, relevant KPIs such as the conversion rate, click-through rate and viewability rate were continuously optimized and increased. The high rate of new customers also speaks for the success of the online marketing measures.

FMTG INVEST CAMPAIGN

-

Investment Target achievement for every campaign with short campaign duration

-

Optimized use of budget

-

Targeted marketing measures in the respective funnel stages

-

High proportion of new investors

Anne Aubrunner

Managing Director